Day 2: What Vehicles Are Covered by Commercial Auto Insurance?

- W. Tom Polowy, MS

- Jan 3

- 5 min read

Welcome back to our Commercial Auto Insurance series. On Day 1, we covered who needs it: Connecticut businesses that own or lease vehicles, contractors and trades using trucks and vans, sole proprietors and freelancers who drive for client work, and companies whose employees use personal cars for errands or deliveries. If a vehicle moves people, products, or equipment for your business—even part-time—you’re in the group that needs commercial auto coverage.

Today, we’re focusing on which vehicles are covered and how that plays out across common industries. You’ll see how passenger cars, pickups, cargo vans, box trucks, semis, and specialty units fit into real Connecticut operations in construction, food service, professional services, and retail/delivery.

Quick heads-up for tomorrow: we’ll unpack the risks of relying on a personal auto policy for business use—and what to do instead to protect your company.

Core Vehicles Covered by Commercial Auto Insurance

Commercial auto insurance protects a wide range of business vehicles, from basic passenger cars to specialized commercial equipment. The fundamental principle is simple: if your business owns, leases, rents, or regularly uses a vehicle for business operations, commercial auto insurance can provide coverage.

Standard Business Vehicles

Passenger Cars and Sedans Any car used for business purposes qualifies for commercial auto coverage. Connecticut real estate agents driving clients to showings, insurance brokers meeting with customers, or consultants traveling to client sites all benefit from commercial auto protection on their passenger vehicles.

Pickup Trucks Pickup trucks represent one of the most common commercial vehicles in Connecticut. Landscaping companies, contractors, and small delivery services rely heavily on pickup trucks for daily operations. Commercial auto insurance covers both light-duty and heavy-duty pickup trucks used for business purposes.

Vans and Cargo Vans Vans serve countless Connecticut businesses, from plumbing and electrical contractors to catering companies and delivery services. Commercial auto policies cover cargo vans, passenger vans, and specialized conversion vans used for business operations.

Commercial Trucks and Heavy-Duty Vehicles

Box Trucks and Step Vans Medium-duty trucks with enclosed cargo areas are essential for many Connecticut businesses. Moving companies, appliance stores, and wholesale distributors depend on box trucks for daily operations. Commercial auto insurance provides comprehensive protection for these valuable business assets.

Semi-Trucks and Tractor-Trailers Long-haul trucking operations and local freight companies operating in Connecticut need specialized commercial auto coverage for semi-trucks, tractor-trailers, and commercial trailers. These policies often include additional protections specific to commercial transportation.

Dump Trucks and Construction Vehicles Connecticut's construction industry relies heavily on specialized vehicles like dump trucks, cement mixers, and other heavy equipment. Commercial auto insurance can cover these vehicles when they're being driven on public roads.

Industry-Specific Vehicle Applications

Understanding how different Connecticut industries use commercial vehicles helps illustrate the breadth of coverage available.

Construction and Trades

Connecticut construction companies typically operate fleets including pickup trucks for supervisors, cargo vans for tools and materials, and specialized vehicles for equipment transport. Electricians, plumbers, and HVAC technicians often use cargo vans or trucks equipped with ladder racks and tool storage systems.

Food Service and Catering

Connecticut's thriving food service industry includes food trucks, catering vans, and delivery vehicles. Commercial auto insurance covers everything from mobile kitchens operating at Hartford festivals to restaurant delivery cars serving customers throughout the state.

Professional Services

Even service-based businesses need commercial auto coverage. Connecticut accounting firms, consulting companies, and professional services often use passenger cars or small SUVs for client visits, requiring appropriate commercial coverage.

Retail and Delivery

E-commerce growth has increased demand for delivery vehicles in Connecticut. Retail businesses using vans for local deliveries, florists with delivery trucks, and online retailers operating their own delivery fleets all benefit from commercial auto protection.

Owned vs. Leased vs. Rented Vehicles

Commercial auto insurance adapts to different vehicle ownership arrangements common among Connecticut businesses.

Owned Vehicles

Businesses that own their vehicles outright have the most straightforward coverage needs. Commercial auto policies provide comprehensive protection for business-owned cars, trucks, and vans, including physical damage coverage and liability protection.

Leased Vehicles

Many Connecticut businesses lease commercial vehicles to preserve cash flow and maintain newer fleets. Commercial auto insurance works seamlessly with leased vehicles, often meeting or exceeding leasing company insurance requirements while providing additional business-specific protections.

Rented and Hired Vehicles

Businesses occasionally rent vehicles for temporary needs or hire vehicles with drivers for specific projects. Commercial auto policies can include hired and non-owned auto coverage, protecting your business when employees drive rental vehicles or their personal vehicles for business purposes.

Specialty and Unique Vehicle Coverage

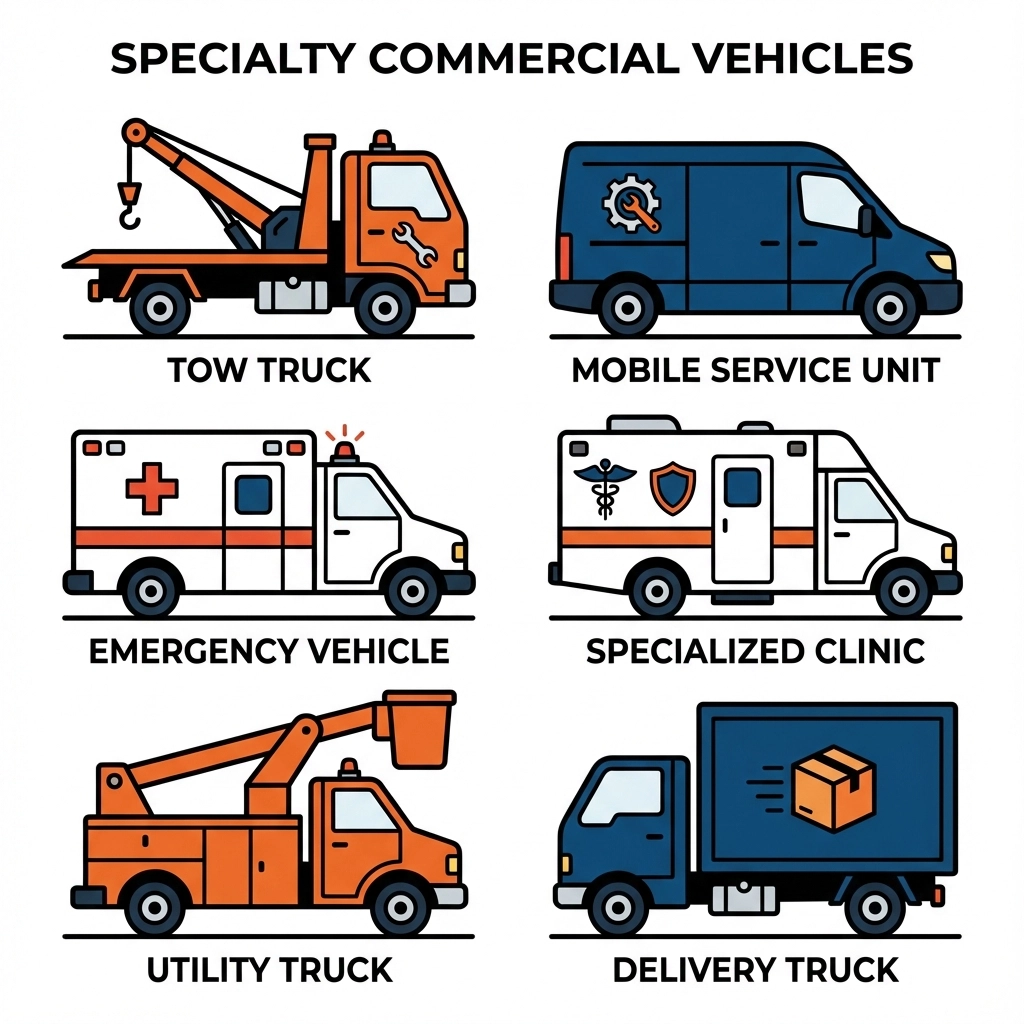

Connecticut businesses operate many specialized vehicles that require commercial auto coverage.

Emergency and Service Vehicles

Tow trucks, emergency response vehicles, and mobile service units qualify for commercial auto coverage. Connecticut towing companies, mobile mechanics, and emergency services need specialized policies addressing their unique operational risks.

Recreational and Utility Vehicles

Some businesses use ATVs, UTVs, or other specialty vehicles for operations like property maintenance, security patrols, or specialized services. Commercial auto policies can extend coverage to these vehicles when used for business purposes.

Mobile Businesses

Food trucks, mobile pet grooming services, and mobile repair shops operate throughout Connecticut. These businesses need comprehensive commercial auto coverage that protects both the vehicle and the business equipment it carries.

Connecticut-Specific Considerations

Connecticut's unique geography and business environment create specific considerations for commercial auto insurance.

Weather-Related Risks

Connecticut's harsh winters and severe weather events pose significant risks for commercial vehicles. Snow, ice, and storm damage claims are common, making comprehensive physical damage coverage essential for Connecticut businesses.

Urban vs. Rural Operations

Businesses operating in Connecticut's urban centers like Hartford, New Haven, and Bridgeport face different risks than those serving rural areas. Urban operations deal with higher traffic density and theft risks, while rural businesses may encounter road condition challenges and longer emergency response times.

Interstate Commerce

Many Connecticut businesses operate across state lines, particularly into New York and Massachusetts. Commercial auto policies must provide adequate coverage for interstate operations while meeting varying state requirements.

What's Not Covered by Standard Commercial Auto

Understanding coverage limitations helps Connecticut business owners make informed decisions about additional protections.

Personal Use Exclusions

Commercial auto policies typically exclude personal use of business vehicles. If employees regularly use company vehicles for personal errands, additional coverage or policy modifications may be necessary.

Racing and Competition

Commercial auto policies exclude racing, competitive events, and other high-risk activities. Connecticut businesses involved in motorsports or competitive driving need specialized coverage.

Criminal Activity

Commercial auto insurance doesn't cover vehicles used for illegal activities or criminal enterprises. Standard business operations are covered, but intentional criminal acts are excluded.

Coverage Enhancements and Add-Ons

Connecticut businesses can customize commercial auto coverage with various enhancements.

Equipment Coverage

Mobile businesses can add coverage for tools, equipment, and specialized business property carried in commercial vehicles. This protection is particularly valuable for contractors and service providers.

Business Interruption

Some commercial auto policies include business interruption coverage, helping Connecticut businesses maintain operations when covered vehicles are out of service due to claims.

Rental Reimbursement

When commercial vehicles require repairs after covered losses, rental reimbursement coverage helps Connecticut businesses maintain operations by covering temporary replacement vehicle costs.

Making Coverage Decisions for Your Connecticut Business

Selecting appropriate commercial auto coverage requires careful consideration of your business operations, vehicle types, and risk exposures.

Assessing Your Fleet Needs

Connecticut businesses should evaluate all vehicles used for business purposes, including employee-owned vehicles used for business activities. This assessment ensures comprehensive protection without coverage gaps.

Understanding Industry Requirements

Some Connecticut industries have specific insurance requirements. Transportation companies, contractors working on public projects, and businesses serving government contracts often need to meet minimum coverage levels or specific policy provisions.

Budgeting for Appropriate Coverage

Commercial auto insurance represents a significant business expense, but inadequate coverage poses even greater financial risks. Connecticut businesses should balance premium costs with comprehensive protection needs.

Tomorrow, we'll explore the essential coverage types within commercial auto policies and how each protects your Connecticut business operations. Understanding these coverage components helps you make informed decisions about policy limits and deductibles that align with your business needs and budget constraints.

Your commercial vehicles represent significant business investments that deserve comprehensive protection. Working with experienced business insurance Connecticut professionals ensures your coverage matches your operational needs while providing cost-effective protection for your valuable business assets.

.png)

Comments