Day 3: The Real Risks: Why Personal Auto Insurance Won't Cover Your Business Use

- W. Tom Polowy, MS

- 6 days ago

- 6 min read

This is Day 3 of our 7-part series on commercial auto insurance for Connecticut business owners. In Day 1, we explained who truly needs commercial auto coverage, and in Day 2, we outlined which vehicles and uses are eligible. Today, we focus on why a personal auto policy isn't enough for business driving—and what that gap can cost you.

You're running errands for your business in your personal vehicle. Maybe you're delivering products to a client, picking up supplies, or driving to a job site. It feels routine, even harmless. Your personal auto insurance should cover you, right?

Wrong. And this misconception costs Connecticut business owners thousands of dollars in denied claims every year.

The stark reality is that most personal auto insurance policies contain explicit exclusions for business use. When an accident happens during business activities, you might discover your coverage has vanished exactly when you need it most. You'll be left holding the bill for vehicle repairs, medical expenses, property damage, and potentially devastating legal costs.

The Coverage Illusion: Why Personal Policies Draw the Line

Personal auto insurance operates on a fundamental principle: it's designed for personal transportation risks. When you use your vehicle for business purposes, you've crossed into an entirely different risk category that personal policies simply aren't built to handle.

Higher Financial Exposure Creates Bigger Claims

Business driving generates substantially larger potential losses than personal use. Consider these scenarios that personal policies often exclude:

You're transporting expensive equipment that gets damaged in an accident

A client is injured while riding in your vehicle during a site visit

You cause property damage while backing out of a commercial loading dock

Legal fees mount when a business-related accident leads to a lawsuit

Commercial activities routinely involve higher-value assets, professional liability concerns, and more complex legal situations. Personal auto policies typically offer state-minimum liability coverage, often just $25,000 per person and $50,000 per accident in Connecticut. Business-related claims frequently exceed these limits by substantial margins.

Policy Language Creates Clear Exclusions

Most personal auto policies contain specific language excluding coverage when the vehicle is used for business purposes. This isn't an oversight: it's intentional risk management by insurance companies. Common exclusionary language includes phrases like "business pursuits" or "commercial activities."

Insurance companies write these exclusions because business use changes your risk profile significantly. You're driving more frequently, often in unfamiliar areas, carrying valuable cargo, and potentially transporting customers or employees. Each of these factors increases the likelihood and severity of potential claims.

Regulatory Compliance Issues

Some Connecticut municipalities and business types require commercial auto insurance by law. Operating with only personal coverage doesn't just leave you unprotected: it could put you in violation of local regulations. This creates additional legal exposure beyond just insurance coverage gaps.

Common Claim Scenarios That Get Denied

Understanding specific situations where personal auto insurance fails business owners helps illustrate the real-world impact of this coverage gap.

The Delivery Disaster

Sarah runs a small catering business in Hartford. She's delivering lunch to a corporate client when another driver runs a red light and totals her vehicle. The catering equipment in her car is destroyed, and she suffers injuries that require medical treatment.

Her personal auto insurance denies the entire claim because the accident occurred during commercial delivery activities. Sarah faces:

$15,000 in vehicle replacement costs

$8,000 in destroyed catering equipment

$12,000 in medical bills

Lost income during recovery

Potential legal liability if the client's lunch caused food poisoning

The Client Transport Problem

Mike operates a home inspection business in New Haven. He's driving a client to inspect a second property when he rear-ends another vehicle at a traffic light. Both Mike and his client require emergency room treatment.

Personal auto insurance coverage is denied because transporting clients for business purposes violates the policy terms. Mike now owes:

Vehicle repair costs

His own medical expenses

His client's medical expenses

Potential lawsuit from the other driver

Lost business reputation

The Equipment Catastrophe

Jennifer owns a landscaping company in Fairfield. Her truck, loaded with $25,000 worth of commercial lawn equipment, is stolen from a job site overnight.

Her personal auto policy covers the vehicle theft but excludes the business equipment completely. Jennifer loses her entire inventory of professional tools, effectively shutting down her business until she can replace everything out of pocket.

The Financial Reality of Going Unprotected

When personal auto insurance denies a business-related claim, you become personally responsible for all associated costs. This financial exposure includes several categories that can quickly spiral into business-threatening amounts.

Direct Damages and Replacement Costs

Vehicle repairs or replacement represent just the beginning of your financial exposure. Business vehicles often carry valuable equipment, inventory, or tools that personal policies won't cover. Replacing specialized business equipment can cost tens of thousands of dollars.

Medical and Legal Expenses

Business-related accidents involving employees, customers, or the general public create complex liability situations. Medical expenses alone can reach six figures for serious injuries. Legal defense costs, even for ultimately successful cases, routinely exceed $50,000.

Lost Income and Business Disruption

Vehicle accidents during business activities often create extended periods of lost income. If your vehicle is essential to business operations, every day without transportation represents lost revenue. For service-based businesses, this disruption can devastate customer relationships and market position.

Regulatory Fines and Penalties

Operating without required commercial coverage can result in fines, license suspensions, and other regulatory penalties. These administrative costs compound the financial damage from the original incident.

Defining the Business Use Threshold

Understanding what constitutes business use helps clarify when you need commercial coverage. The determination isn't always obvious, and the stakes for guessing wrong are substantial.

Frequency-Based Definitions

Many personal auto policies allow occasional or incidental business use, typically defined as business driving comprising 20% or less of your annual miles. However, this threshold is often misunderstood or miscalculated by business owners.

Regular activities that typically exceed the incidental use threshold include:

Daily commutes to multiple job sites

Regular client visits or meetings

Routine supply pickups or deliveries

Transportation of business equipment or inventory

Activity-Based Exclusions

Beyond frequency, certain business activities automatically void personal coverage regardless of how often they occur:

Transporting paying passengers (rideshare, taxi services)

Delivering goods for compensation

Using the vehicle as a mobile office or workspace

Carrying hazardous materials or specialized business equipment

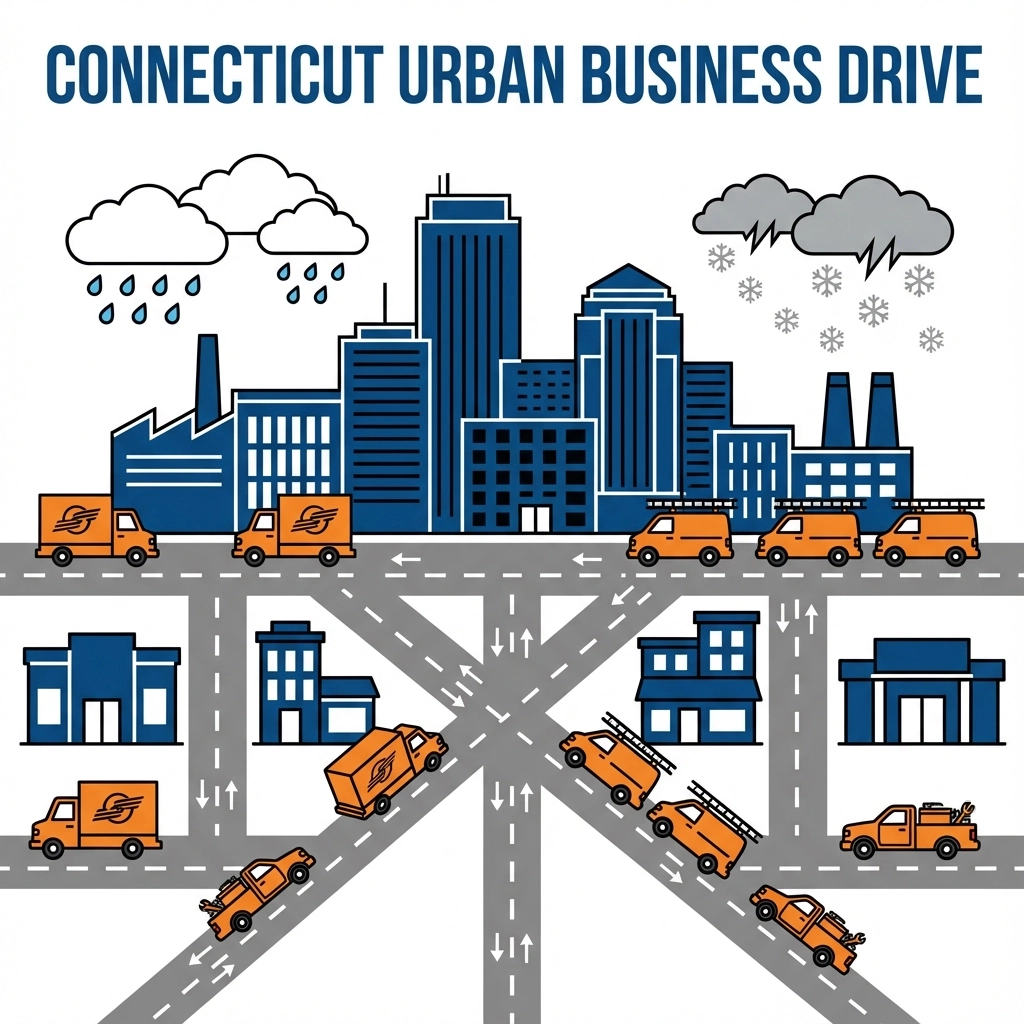

Connecticut-Specific Considerations

Connecticut's dense urban areas and extensive business districts mean many business owners regularly drive for work purposes. The state's seasonal weather patterns also create periods of increased business driving for industries like construction, landscaping, and home services.

Local factors that often push business owners over the incidental use threshold include:

Multi-town service territories requiring extensive travel

Seasonal work patterns with concentrated driving periods

Urban delivery routes with frequent stops

Client-based services requiring on-site visits

Available Protection Options

Several coverage options can bridge the gap between personal auto insurance and full commercial policies, depending on your specific business needs and risk exposure.

Commercial Auto Insurance

Full commercial auto insurance provides comprehensive protection designed specifically for business use. These policies typically include:

Higher liability limits (often $1 million combined single limit)

Coverage for business equipment and cargo

Protection for employees and authorized drivers

Broader geographic coverage areas

Specialized endorsements for industry-specific risks

Commercial policies cost more than personal coverage but provide substantially broader protection that matches business-level risks.

Business Use Endorsements

Some insurance companies offer limited business use endorsements that extend personal auto policies to cover light commercial activities. These endorsements work best for:

Occasional client visits or meetings

Limited business travel (under 20% of annual miles)

Professional services without equipment transportation

Low-risk business activities

However, these endorsements often include significant limitations and may not provide adequate protection for businesses with substantial commercial auto exposure.

Hired and Non-Owned Auto Coverage

Hired and Non-Owned Auto (HNOA) insurance protects your business when employees use personal vehicles, rental cars, or borrowed vehicles for work purposes. This coverage fills critical gaps but doesn't replace the need for commercial coverage on business-owned vehicles.

Making the Right Coverage Decision

Choosing appropriate auto insurance for business activities requires honest assessment of your actual vehicle use patterns and risk exposure.

Document Your Driving Patterns

Track your business-related driving for several weeks to understand your actual usage patterns. Include:

Miles driven for business purposes

Frequency of business trips

Types of business activities requiring vehicle use

Value of equipment or inventory regularly transported

Evaluate Your Risk Exposure

Consider the potential financial impact if your personal auto insurance denied a business-related claim. Calculate:

Typical value of business equipment in your vehicle

Potential liability from transporting clients or employees

Cost of business interruption if your vehicle was unavailable

Your ability to personally cover these expenses

Consult with Insurance Professionals

Commercial auto insurance requirements vary significantly based on business type, vehicle use, and individual risk factors. Working with experienced agents who understand business insurance helps ensure you get appropriate protection without paying for unnecessary coverage.

Protecting Your Connecticut Business

The gap between personal and commercial auto insurance represents one of the most common: and expensive: coverage mistakes made by Connecticut business owners. Personal auto policies simply aren't designed to handle business risks, and discovering this limitation after an accident creates devastating financial consequences.

Every day you operate your business using personal auto insurance for commercial activities, you're essentially self-insuring against potentially catastrophic losses. The cost of appropriate commercial coverage represents a fraction of your potential exposure from a single denied claim.

Don't let a coverage misunderstanding destroy your business. Understanding these limitations is the first step toward protecting your Connecticut business with appropriate commercial auto insurance.

Tomorrow in Day 4: How much does commercial auto insurance cost? We'll break down pricing factors, real-world ranges, and smart ways to control your premium without sacrificing protection.

Ready to evaluate your current auto insurance coverage for business use? Contact our Connecticut business insurance specialists at 860-440-7324 or visit our commercial auto insurance resources to ensure your business has the protection it needs.

.png)

Comments