Day 4: How Much Does Commercial Auto Insurance Cost in Connecticut?

- W. Tom Polowy, MS

- 4 days ago

- 6 min read

On Day 3, we covered the real on-the-road risks facing Connecticut businesses—accidents, injuries, property damage, and lawsuit exposure—and why "good enough" isn't real protection. One bad crash on I-95 or a delivery mishap downtown can drain cash flow, sideline vehicles, and put your reputation at risk.

When you started shopping for commercial auto, the quotes probably made your head spin. One carrier quoted $1,500 per vehicle annually, another came in at $3,200, and a third wanted over $4,000. Today, on Day 4, we're digging into the real costs of commercial auto insurance in Connecticut—what drives the price, why the range is so wide, and why the right coverage is worth it when something goes wrong.

You'll learn how to read pricing in context so you pay for protection that matches your actual risk, not just a number on a spreadsheet. And stick around—next up in this series: what does commercial auto actually cover?

What Connecticut Businesses Actually Pay

The average commercial auto insurance cost in Connecticut ranges from $1,762 to $2,100 annually per vehicle. Most business owners pay between $147 to $178 monthly per vehicle, though your actual premium could fall anywhere from $1,200 to over $6,000 depending on specific factors.

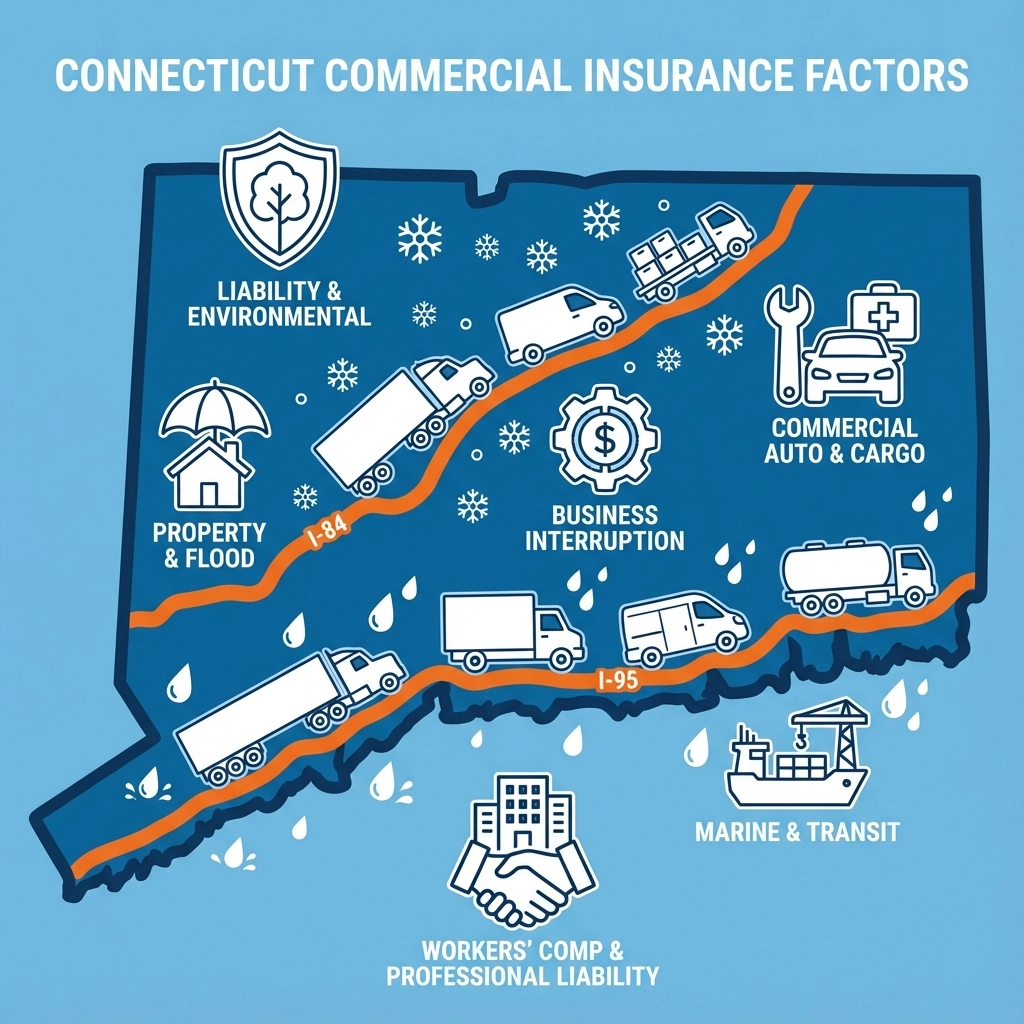

These numbers place Connecticut on the higher end of national averages, primarily due to our state's dense traffic corridors along I-84 and I-95, frequent weather-related claims, and higher repair costs in metropolitan areas like Hartford, New Haven, and Bridgeport.

The Six Major Cost Factors

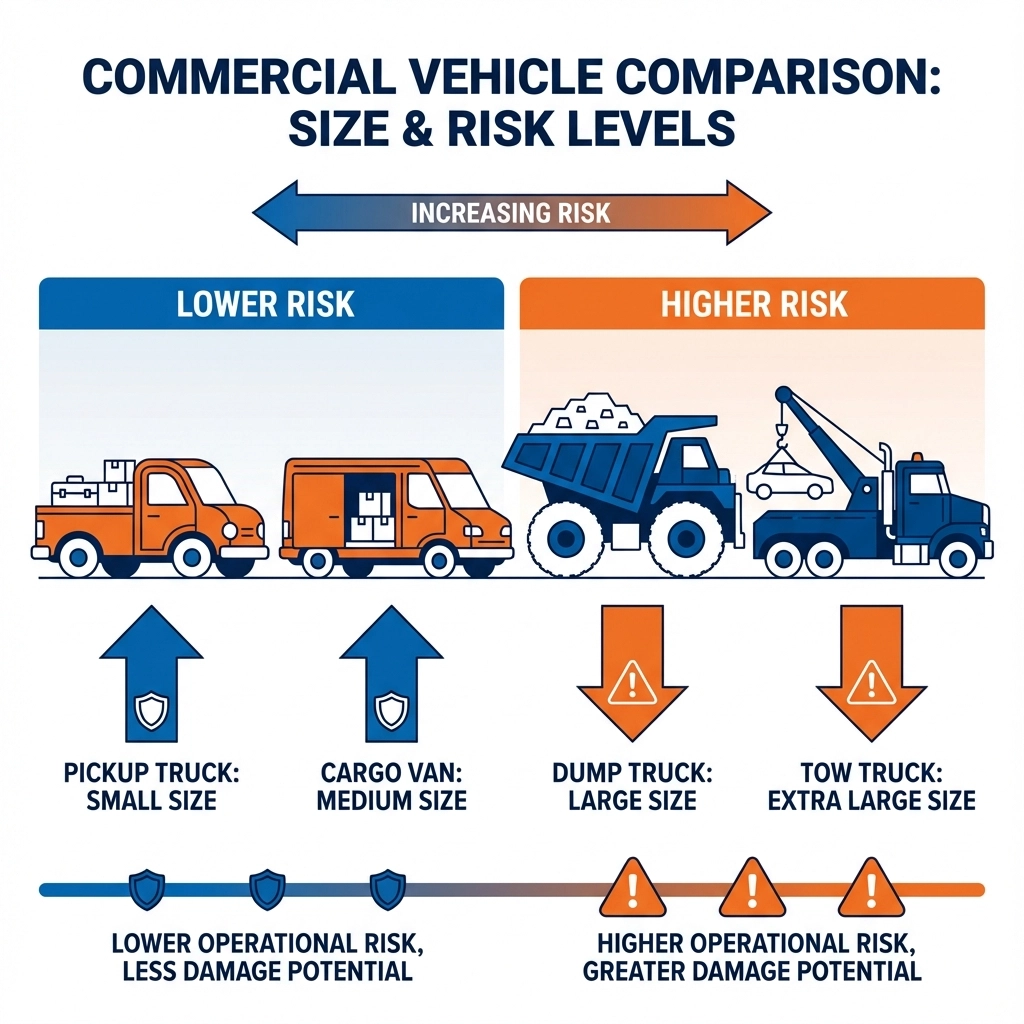

1. Vehicle Type and Value

Your vehicle choice dramatically impacts premiums. A basic pickup truck used for occasional deliveries costs significantly less to insure than a heavy-duty dump truck or specialized equipment hauler.

Low-risk vehicles (annual premiums):

Standard pickup trucks: $1,200 - $1,800

Basic cargo vans: $1,400 - $2,000

Small box trucks: $1,600 - $2,200

High-risk vehicles (annual premiums):

Tow trucks: $3,500 - $6,000

Cement mixers: $4,000 - $7,500

Multi-vehicle transport carriers: $5,000 - $10,000+

2. Business Type and Operations

Insurance carriers assess risk differently based on your industry. A consulting firm with occasional client visits poses minimal risk compared to a courier service making 50 daily deliveries.

Lower-risk businesses:

Professional services with occasional travel

Real estate agents

Sales representatives

Small retail operations

Higher-risk businesses:

Delivery and courier services

Construction contractors

Food service and catering

Transportation and logistics

3. Driver Records and Experience

Your drivers' histories directly influence premiums. Clean driving records can reduce costs by 15-25%, while multiple violations or accidents can double your rates.

Premium impact of violations:

Clean record (5+ years): Baseline rate

Single speeding ticket: 10-15% increase

At-fault accident: 20-30% increase

DUI/DWI: 50-100+ increase

Multiple violations: 75-150% increase

4. Annual Mileage and Geographic Coverage

High-mileage operations face greater exposure to accidents and claims. Additionally, vehicles operating primarily in Hartford or New Haven pay more than those serving rural Connecticut communities.

Mileage-based pricing:

Under 10,000 miles annually: Lower rates

10,000 - 25,000 miles: Standard rates

25,000 - 50,000 miles: 15-25% increase

Over 50,000 miles: 30-50% increase

5. Coverage Limits and Deductibles

Connecticut requires minimum liability coverage of $25,000/$50,000/$25,000, but most businesses need higher limits. Your deductible choice also affects premiums: higher deductibles reduce monthly costs but increase out-of-pocket expenses during claims.

Popular coverage configurations:

Minimum liability: $500-800 annually

$100,000/$300,000/$100,000: $1,200-1,800 annually

$500,000/$1,000,000/$500,000: $2,000-3,000 annually

$1,000,000+ umbrella coverage: Additional $300-600 annually

6. Claims History

Your business's claims history over the past 3-5 years significantly impacts pricing. Frequent small claims often increase premiums more than occasional larger ones, as they suggest ongoing risk management issues.

Real Connecticut Business Examples

Example 1: West Hartford Landscaping Company

Business: 8 pickup trucks and 2 trailers

Annual mileage: 15,000 per vehicle (local routes)

Driver ages: 28-45 with clean records

Coverage: $250,000/$500,000/$250,000

Annual premium: $14,400 ($1,800 per vehicle)

Example 2: New Haven Delivery Service

Business: 12 cargo vans

Annual mileage: 35,000 per vehicle (statewide delivery)

Driver ages: 22-55 with mixed records

Coverage: $500,000/$1,000,000/$500,000

Annual premium: $36,000 ($3,000 per vehicle)

Example 3: Stamford Professional Services

Business: 4 sedans for client visits

Annual mileage: 8,000 per vehicle

Driver ages: 35-50 with excellent records

Coverage: $100,000/$300,000/$100,000

Annual premium: $5,200 ($1,300 per vehicle)

Five Ways to Reduce Your Premiums

1. Implement Driver Training Programs

Formal safety training and defensive driving courses can earn 5-15% discounts. Many insurers offer additional savings for businesses maintaining driver training documentation.

2. Install Vehicle Safety Equipment

GPS tracking, dash cameras, and backup sensors reduce accident risk and qualify for technology discounts ranging from 3-10%.

3. Choose Higher Deductibles Strategically

Increasing your physical damage deductible from $500 to $1,000 typically reduces premiums by 8-12%. For comprehensive coverage, consider $2,500+ deductibles if your business can handle larger out-of-pocket expenses.

4. Bundle Coverage Types

Combining commercial auto with general liability, property, or workers' compensation insurance through the same carrier often yields 10-25% multi-policy discounts.

5. Maintain Excellent Credit

Business credit scores significantly impact commercial insurance rates. Maintaining good credit can save 10-20% compared to poor credit ratings.

Why Working with Insurance Brokers Saves Money

Independent insurance brokers provide access to multiple carriers and can identify cost-saving opportunities that direct-to-carrier shopping misses. Here's how brokers add value:

Carrier Relationships

Brokers maintain relationships with 10-20+ insurance companies, including specialty carriers that excel in specific industries. This means comparing apples-to-apples quotes from multiple sources instead of settling for the first reasonable offer.

Risk Management Expertise

Experienced brokers identify coverage gaps and recommend risk management strategies that prevent claims and reduce premiums long-term.

Claims Advocacy

When accidents happen, brokers advocate for fair claim settlements and help navigate complex coverage situations that could otherwise result in denied claims.

Annual Reviews

Professional brokers conduct annual coverage reviews, ensuring your insurance evolves with your business growth and changing risk profile.

Getting Accurate Quotes: What Information You'll Need

Prepare the following information for accurate commercial auto insurance quotes:

Business Information:

Business legal name and DBA

Federal tax ID number

Years in operation

Detailed business description

Annual revenue

Vehicle Details:

Make, model, year for each vehicle

Vehicle identification numbers (VINs)

Purchase dates and current values

Commercial vehicle classifications

Driver Information:

Names and birthdates

License numbers and states

Driving records (past 5 years)

Experience with commercial vehicles

Usage Details:

Annual mileage estimates per vehicle

Primary garaging locations

Operating territories (local, statewide, interstate)

Seasonal usage patterns

Connecticut-Specific Considerations

Weather-Related Risks

Connecticut's winter weather increases accident risk and comprehensive claims. Insurers factor in snow removal equipment, winter driving conditions, and ice-related accidents when pricing policies.

Construction Zone Exposure

Ongoing infrastructure projects along major Connecticut highways create additional risk for commercial vehicles. Businesses operating near construction zones may face higher premiums.

Municipal Regulations

Some Connecticut municipalities impose additional insurance requirements for businesses operating within city limits. Hartford, New Haven, and Waterbury have specific commercial vehicle insurance mandates affecting pricing.

Smart Shopping Strategies

1. Get Multiple Quotes

Obtain quotes from at least 3-5 different carriers or work with a broker who can access multiple markets simultaneously.

2. Review Coverage Annually

Business changes, driver additions, vehicle purchases, and claims history updates all affect pricing. Annual reviews ensure optimal coverage and competitive rates.

3. Consider Captive vs. Independent Options

Captive agents represent single insurance companies, while independent brokers access multiple carriers. Both have advantages depending on your specific needs.

4. Understand Policy Terms

Don't choose coverage based solely on price. Understand coverage limits, deductibles, exclusions, and claim handling procedures before making decisions.

Questions to Ask Before Purchasing

What discounts are available for my specific business type?

How does the carrier handle claims in Connecticut?

Are there additional fees beyond the quoted premium?

What happens if I need to add vehicles mid-term?

How do rate increases typically work with this carrier?

Commercial auto insurance represents a significant business expense, but understanding cost factors helps you make informed decisions. The key is balancing adequate coverage with reasonable premiums while working with insurance professionals who understand Connecticut's unique business environment.

Your vehicles keep your business moving, and proper insurance keeps your business protected. Take time to understand your options, compare quotes comprehensively, and choose coverage that supports your long-term success.

For personalized commercial auto insurance quotes tailored to your Connecticut business, contact Insure Connecticut LLC at 860-440-7324. Our experienced team helps businesses throughout Connecticut find comprehensive coverage at competitive rates.

.png)

Comments