The Flood Insurance Gap: What Homeowners and Businesses Need to Know About Property Coverage Exclusions

- W. Tom Polowy, MS

- 2 days ago

- 9 min read

Every year, floods cause billions of dollars in damage across the United States, yet most property owners remain dangerously underinsured. The sobering reality is that two-thirds of residential flood losses go uninsured, creating a massive protection gap that leaves millions of homeowners and businesses financially vulnerable when disaster strikes.

Between 2010 and 2023, floods caused $144 billion in damage nationwide, but only $50 billion, just 35% of total losses, was covered by insurance. This staggering disparity reveals a critical misunderstanding about property insurance coverage that affects homeowners, renters, and business owners alike.

The flood insurance gap isn't just a problem for coastal communities or areas prone to hurricanes. Inland flooding from heavy rainfall, snowmelt, and storm surges affects properties nationwide, often in areas where owners never imagined they'd need flood protection. Understanding this coverage gap and taking proactive steps to address it could mean the difference between financial recovery and devastating loss.

At Insure Connecticut LLC, we've seen firsthand how property owners struggle with the complexities of flood insurance. Many clients are shocked to learn that their standard homeowners or commercial property policies don't cover flood damage, a misconception that can have catastrophic financial consequences.

Curious about coverage or rates? Request a quote now!

The Hidden Reality of Standard Property Insurance

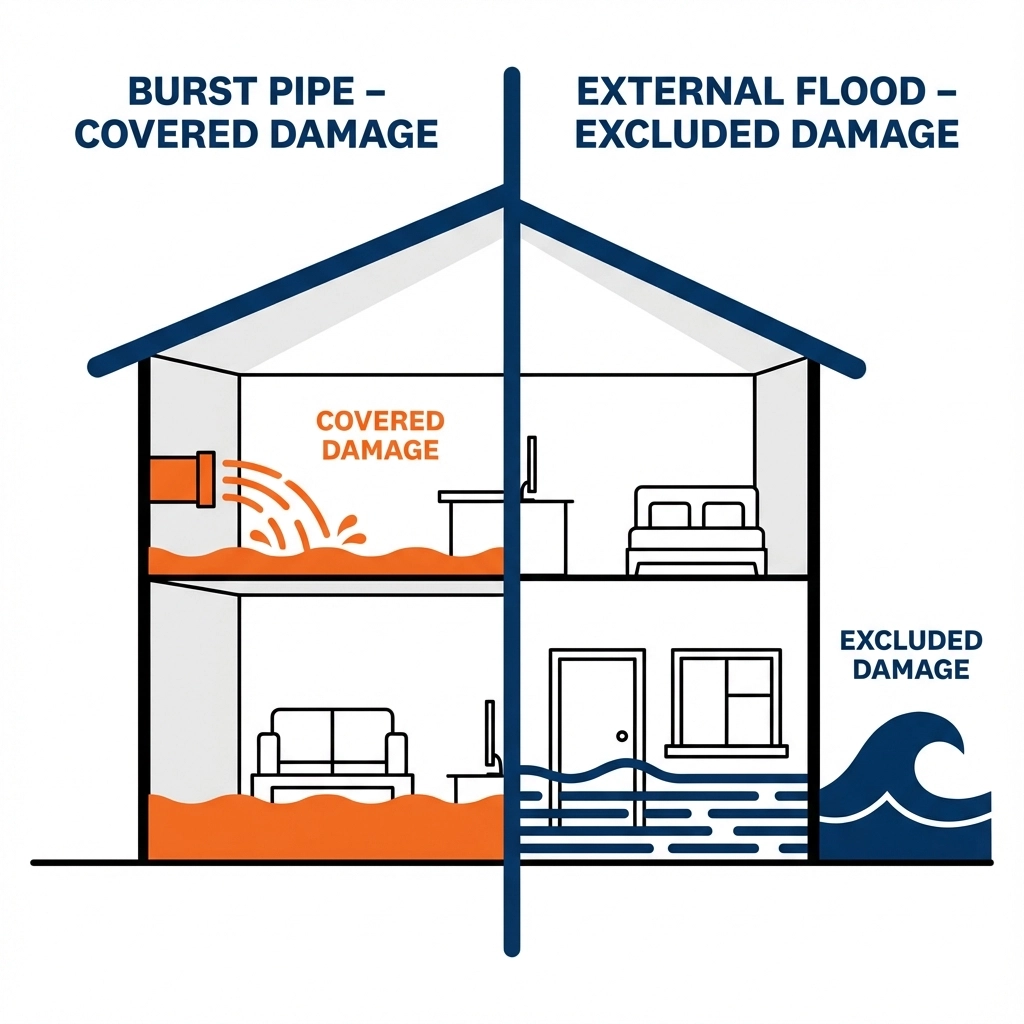

Most property insurance policies explicitly exclude flood damage. This fundamental exclusion catches property owners off guard when they need coverage most. Standard homeowners insurance, renters insurance, and commercial property policies cover many types of water damage, burst pipes, roof leaks, appliance malfunctions, but they specifically exclude damage from floods.

The insurance industry defines flood as water that originates from outside your property and affects multiple properties or large areas. This includes:

Rising water from rivers, streams, or storm drains

Surface water from heavy rainfall that overwhelms drainage systems

Storm surge from hurricanes or coastal storms

Snowmelt that causes widespread flooding

Dam or levee failures

The distinction between covered and excluded water damage is crucial. If a pipe bursts in your basement and floods your home, your homeowners insurance will typically cover the damage. But if heavy rainfall causes surface water to enter your basement through foundation cracks or overwhelmed storm drains, that's considered flood damage and won't be covered.

This distinction becomes even more complex for businesses. A restaurant that suffers water damage from a broken sprinkler system would likely have coverage under their commercial property policy. The same restaurant flooded by rising water from a nearby creek would need separate flood insurance to recover their losses.

Why the Coverage Gap Continues to Widen

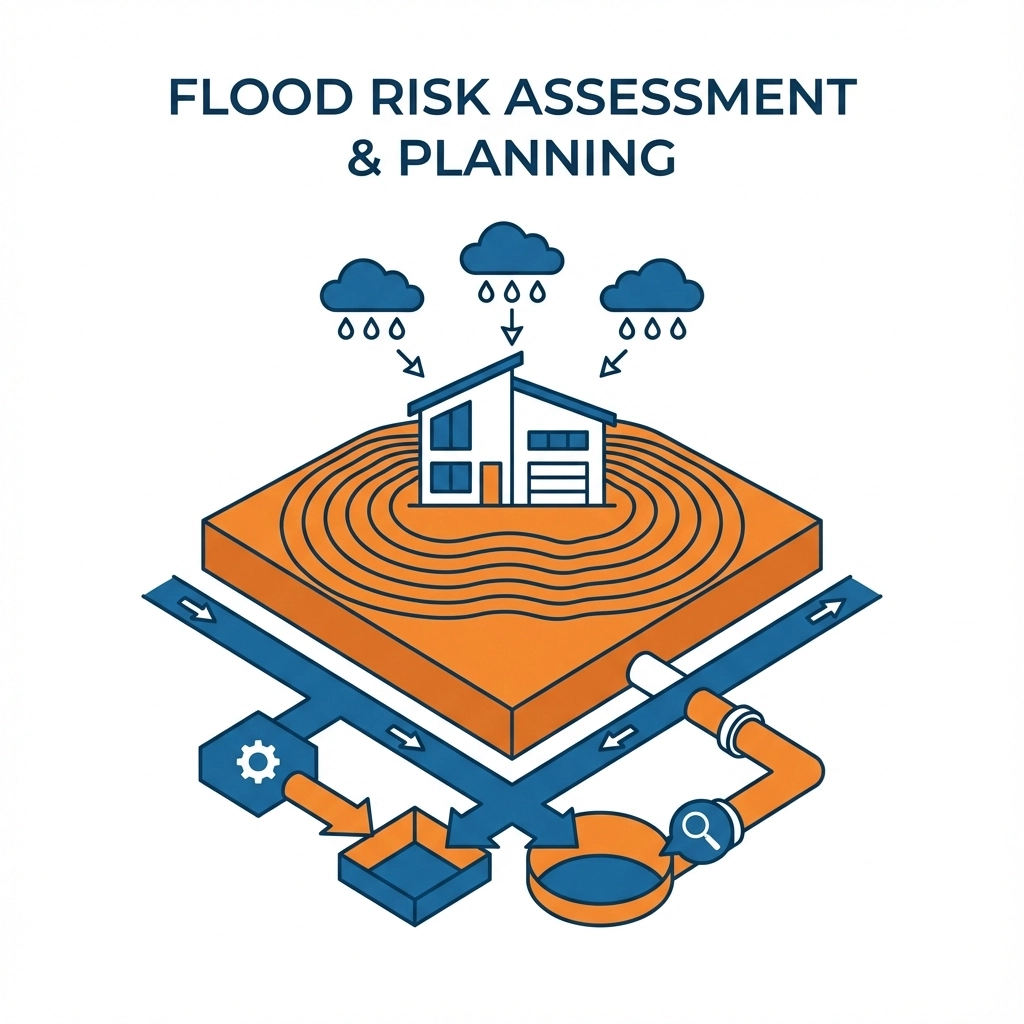

Outdated flood maps create false confidence. FEMA's flood maps, used to determine mandatory flood insurance requirements, are notoriously outdated and inaccurate. These maps often fail to account for:

Heavy rainfall patterns that have intensified due to climate change

New development that alters natural drainage

Infrastructure changes that redirect water flow

Updated weather modeling and flood risk assessment

As a result, approximately 25% of National Flood Insurance Program (NFIP) claims come from properties outside FEMA-designated "high-risk" areas. Property owners in these zones often believe they're safe from flooding and don't need protection.

Low adoption rates persist even where coverage is mandatory. Perhaps most troubling, less than 40% of properties in FEMA-designated high-risk flood zones carry flood insurance. Even when mortgage lenders require flood insurance as a condition of financing, many property owners let their policies lapse after a few years if they haven't experienced flooding.

Affordability barriers prevent adequate coverage. Between 2021 and 2024, private flood insurance costs rose 24% on average, with some states seeing increases of 40% to 60%. These rising costs put comprehensive flood protection out of reach for many property owners, particularly in lower-income communities that often face the highest flood risk.

Understanding Your Flood Risk Beyond the Maps

Flood risk extends far beyond coastal areas. While hurricanes and storm surge generate dramatic headlines, inland flooding causes the majority of flood damage in the United States. Heavy rainfall can overwhelm drainage systems anywhere, causing destructive flooding in areas that seem geographically safe.

Properties at risk include:

Urban areas with limited green space where concrete and asphalt prevent natural water absorption

Properties near streams, creeks, or retention ponds that can overflow during heavy rainfall

Low-lying areas where water naturally collects during storms

Properties with aging storm drain infrastructure that can't handle modern rainfall volumes

Areas with new development that has changed natural water flow patterns

Your property's individual characteristics matter more than general area maps. Factors that increase your specific flood risk include:

Basement or ground-level entrances below street level

Properties at the bottom of hills or slopes

Locations near storm drains or culverts

Buildings with foundations below the base flood elevation

Properties with poor grading that directs water toward structures

The Business Impact of Flood Coverage Gaps

Commercial properties face unique vulnerabilities. Businesses often have higher property values and more complex insurance needs than residential properties. A manufacturing facility, retail store, or office building can represent millions of dollars in building value, equipment, inventory, and business interruption exposure.

Standard commercial property insurance policies exclude flood damage just like homeowners policies. Business owners may assume their comprehensive commercial coverage protects against all natural disasters, but flood requires separate coverage through the NFIP or private insurers.

Business interruption adds another layer of exposure. When flooding damages a business property, the direct property damage is only part of the financial impact. Lost revenue during repairs, employee payroll continuation, temporary relocation costs, and customer relationship damage can exceed the direct property damage costs.

Flood insurance can include business interruption coverage, but many business owners don't understand the waiting periods, coverage limits, and documentation requirements that apply to these claims.

Practical Steps to Assess and Address Your Flood Risk

Start with a professional risk assessment. Don't rely solely on FEMA flood maps to determine your risk level. Insurance professionals can help evaluate your property's specific vulnerability based on:

Elevation relative to nearby water sources

Local drainage infrastructure

Historical flood patterns in your area

Property-specific features that increase or decrease risk

Understand your coverage options beyond NFIP. The National Flood Insurance Program provides basic flood coverage with standardized terms and pricing, but private flood insurance has expanded significantly in recent years. Private insurers often offer:

Higher coverage limits than NFIP policies

Broader coverage definitions

Faster claims processing

Coverage for additional living expenses during repairs

Consider your total exposure, not just your mortgage requirement. If you're required to carry flood insurance, the minimum coverage amount may not adequately protect your investment. NFIP policies are limited to $250,000 for residential structures and $500,000 for commercial buildings, which may not cover full replacement costs for higher-value properties.

Review and update coverage regularly. Property improvements, changes to your area's infrastructure, and evolving flood patterns can all affect your appropriate coverage level. Annual insurance reviews should include flood coverage evaluation, not just your primary property policies.

Common Misconceptions That Increase Financial Risk

"My homeowners insurance covers water damage." While true for certain types of water damage, this statement creates dangerous overconfidence about flood protection. Understanding the difference between covered and excluded water damage is essential for every property owner.

"I'm not in a flood zone, so I don't need flood insurance." FEMA flood zones determine mortgage requirements and NFIP pricing, but they don't determine actual flood risk. Properties outside high-risk zones can and do flood, often catching owners completely unprepared.

"Flood insurance is too expensive for the risk." While flood insurance requires an additional premium, the cost is typically much lower than property owners expect. NFIP policies in moderate-to-low risk areas often cost less than $500 annually, while the average flood claim exceeds $50,000.

"Federal disaster assistance will cover flood damage." Federal disaster declarations provide limited assistance, typically in the form of low-interest loans that must be repaid. This assistance rarely covers full replacement costs and isn't available for all flooding events.

The Economic Impact of Underinsurance

Uninsured flood losses create long-term economic challenges. When property owners lack adequate flood coverage, they often struggle to recover financially from flood damage. This affects not just individual families and businesses, but entire communities.

Research shows that areas with higher flood insurance penetration rates recover more quickly from flood disasters. Properties with insurance can begin repairs immediately, while uninsured properties may remain damaged for months or years as owners seek financing for repairs.

Property values suffer in areas with high uninsured flood losses. When visible flood damage remains unrepaired due to lack of insurance, it affects property values throughout the neighborhood. Prospective buyers become more cautious about flood risk, potentially requiring higher down payments or avoiding the area entirely.

Lenders increasingly recognize uninsured flood risk. Financial institutions are becoming more sophisticated about flood risk assessment, potentially affecting mortgage availability and pricing in areas with low insurance penetration rates.

Technology and Flood Risk Assessment

Advanced modeling provides better risk insights. Modern flood risk assessment uses sophisticated modeling that incorporates rainfall data, topography, development patterns, and infrastructure capacity. These tools provide more accurate risk assessment than traditional FEMA maps.

Property-specific risk assessment is becoming more accessible. Online tools and professional risk assessments can now provide detailed flood risk analysis for individual properties, helping owners make informed decisions about coverage needs.

Real-time monitoring and early warning systems help property owners prepare for potential flooding, but they don't replace the need for adequate insurance coverage when prevention isn't possible.

Building Resilience Through Proper Coverage

Flood insurance provides more than financial protection. Having adequate coverage gives property owners peace of mind and the ability to make rational decisions during flood events. Rather than worrying about financial ruin, insured property owners can focus on safety and recovery.

Coverage enables faster recovery and rebuilding. Insurance claims processing, while sometimes complex, provides a clear path to financial recovery after flood damage. Uninsured property owners often face months of uncertainty while seeking alternative funding sources.

Proper coverage supports community resilience. Communities with higher insurance penetration rates recover more quickly from flood disasters, maintaining property values and economic stability.

Frequently Asked Questions About Flood Insurance Coverage

Q: How is flood insurance different from water damage coverage in my homeowners policy?

A: Homeowners insurance covers water damage from sources inside your property, like burst pipes or appliance leaks. Flood insurance covers water that comes from outside and affects multiple properties, such as rising water from storms, river overflow, or surface water from heavy rainfall.

Q: Do I need flood insurance if I'm not in a high-risk flood zone?

A: FEMA flood zones determine mortgage requirements, but about 25% of flood claims come from properties outside high-risk zones. Flood insurance for properties in moderate-to-low risk areas is often surprisingly affordable and can prevent catastrophic financial loss.

Q: How long does it take for flood insurance to take effect?

A: Most flood insurance policies have a 30-day waiting period before coverage begins, though there are exceptions for new mortgage requirements. Don't wait for storm season to purchase coverage.

Q: What's the difference between NFIP and private flood insurance?

A: The National Flood Insurance Program offers standardized coverage with government backing, while private insurers may offer higher coverage limits, broader definitions, and additional features. Both options are worth exploring based on your specific needs.

Q: Can businesses get flood insurance for equipment and inventory?

A: Yes, commercial flood insurance can cover buildings, business personal property (equipment, inventory, furniture), and business interruption. Coverage limits and terms vary between NFIP and private insurers.

Q: Will federal disaster assistance cover my flood damage if I don't have insurance?

A: Federal disaster assistance is limited and usually comes as low-interest loans that must be repaid. It's not available for all flooding events and rarely covers full replacement costs.

Q: How do I determine how much flood insurance coverage I need?

A: Consider your property's replacement cost, personal property value, and additional living expenses during repairs. NFIP has coverage limits, so higher-value properties may need private insurance or excess coverage to be fully protected.

Taking Action to Protect Your Investment

The flood insurance gap represents one of the most significant financial risks facing property owners today. With flooding becoming more frequent and severe, the cost of remaining uninsured continues to rise.

Understanding that standard property insurance doesn't cover flood damage is the first step toward protecting your investment. Whether you own a home, rental property, or business, evaluating your flood risk and coverage options should be a priority, not an afterthought.

Don't let outdated flood maps or misconceptions about your risk level leave you financially vulnerable. The peace of mind that comes with proper flood coverage far outweighs the cost of premiums, especially when you consider the average flood claim exceeds $50,000.

At Insure Connecticut LLC, we help property owners navigate the complexities of flood insurance and find coverage that matches their specific needs and budget. Our experienced agents understand both NFIP and private flood insurance options and can help you make informed decisions about protecting your most valuable investments.

Ready to evaluate your flood insurance needs? Contact our team at 860-440-7324 or visit our website to schedule a comprehensive insurance review. Don't wait for the next storm forecast to discover you're underprotected: take action today to close your flood insurance gap and protect your financial future.

Curious about coverage or rates? Request a quote now!

Remember, when it comes to flood insurance, the best time to buy coverage was yesterday. The second-best time is right now, before you need it. Your financial security may depend on the decision you make today.

.png)

Comments