Why Connecticut Homeowners with Over $2 Million in Construction Value Need a Claims Diary (And How to Start Yours)

- W. Tom Polowy, MS

- Dec 31, 2025

- 5 min read

When you've invested over $2 million in construction or renovation work on your Connecticut home, you're not just dealing with any ordinary property: you're managing a significant financial asset with complex systems, premium materials, and custom features that standard insurance processes weren't designed to handle efficiently.

The harsh reality? Most insurance adjusters see maybe one or two high-value claims per year. When your kitchen renovation alone costs more than many people's entire homes, the typical claims process can become a nightmare of miscommunication, undervaluation, and endless delays.

That's where a claims diary becomes your secret weapon.

What Is a Claims Diary and Why Does It Matter for High-Value Properties?

A claims diary is a systematic record of every interaction, decision, photo, receipt, and detail related to your insurance claim. Think of it as your property's medical chart: a comprehensive document that tells the complete story of what happened, when it happened, and how it's being addressed.

For Connecticut homeowners with substantial construction investments, this documentation becomes critical for several reasons:

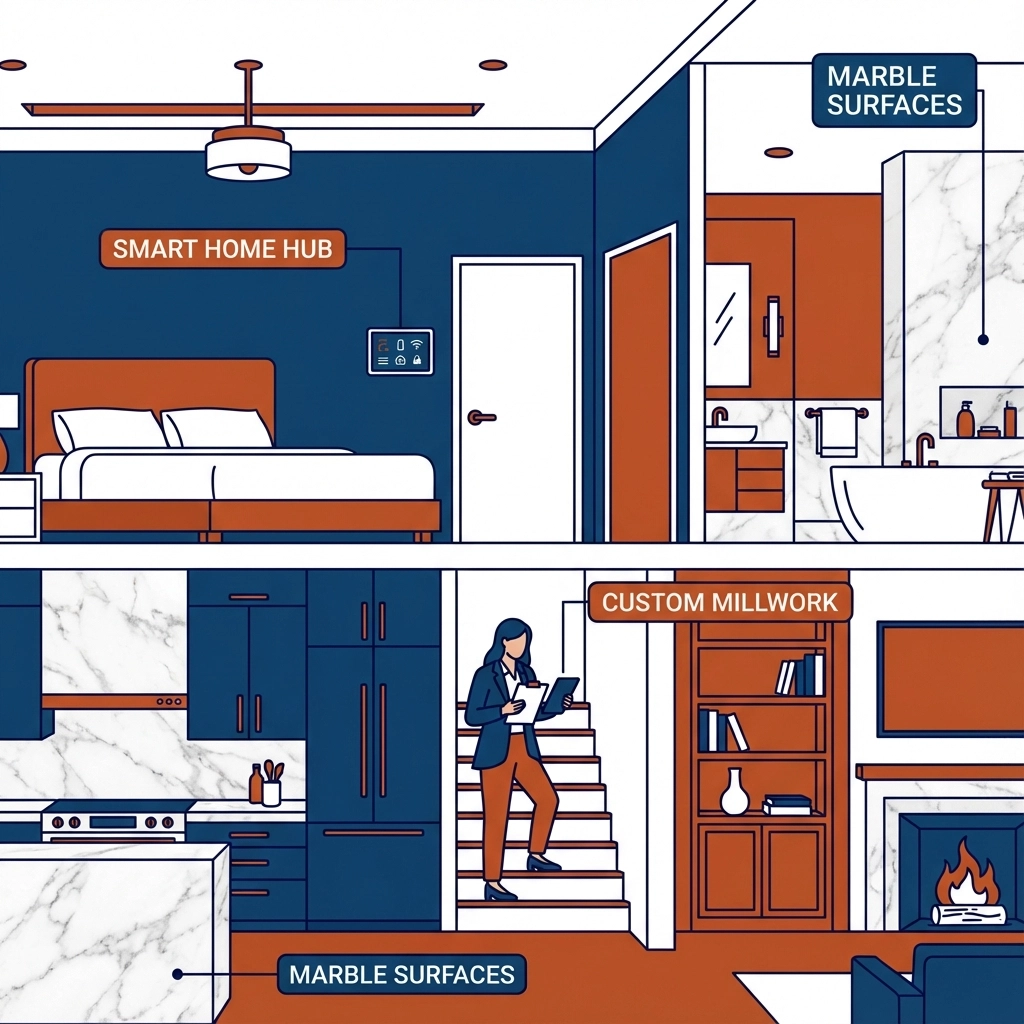

Your Property Has Unique Features That Require Expert Documentation When you have imported Italian marble countertops, custom millwork, or a state-of-the-art home automation system, standard insurance forms don't capture the complexity. Your claims diary becomes the bridge between what you actually own and what the insurance company understands.

Complex Claims Take Months or Years to Resolve High-value claims often involve multiple specialists, custom replacements, and intricate repair processes. Without detailed documentation, important details get lost, conversations are forgotten, and your claim can stall indefinitely.

The Hidden Costs of Poor Documentation in Luxury Home Claims

Connecticut homeowners who've experienced significant losses know the frustration of fighting for proper coverage. Consider these common scenarios:

The Custom Kitchen Catastrophe Water damage destroys your $150,000 custom kitchen. The adjuster sees "kitchen cabinets" and offers $20,000 replacement value. Without your claims diary documenting the custom hardwood species, hand-carved details, and specialized hardware, you're facing a six-figure out-of-pocket expense.

The Smart Home System Struggle A fire damages your integrated home automation system worth $75,000. The adjuster doesn't understand the interconnected components. Your claims diary's detailed records of installation costs, system specifications, and vendor information becomes crucial evidence.

The Luxury Bathroom Nightmare Storm damage affects your spa-like master bathroom with heated floors, steam shower, and imported fixtures. Standard replacement estimates miss the mark by tens of thousands without proper documentation of the original specifications and costs.

Essential Components of an Effective Claims Diary

Your claims diary should capture every aspect of your claim from the moment damage occurs through final resolution. Here's what to include:

Initial Documentation (Within 24 Hours)

Date and time of discovery

Initial photos from multiple angles

Immediate actions taken (calling emergency services, contractors, etc.)

Weather conditions (if relevant)

Contact information for emergency responders

Ongoing Claim Communications

Date and time of every phone call

Names and titles of everyone you speak with

Summary of conversation topics

Promises or commitments made

Reference numbers or case numbers mentioned

Financial Documentation

All receipts for emergency services

Temporary housing expenses

Additional living costs

Quotes from contractors and specialists

Original construction/renovation invoices

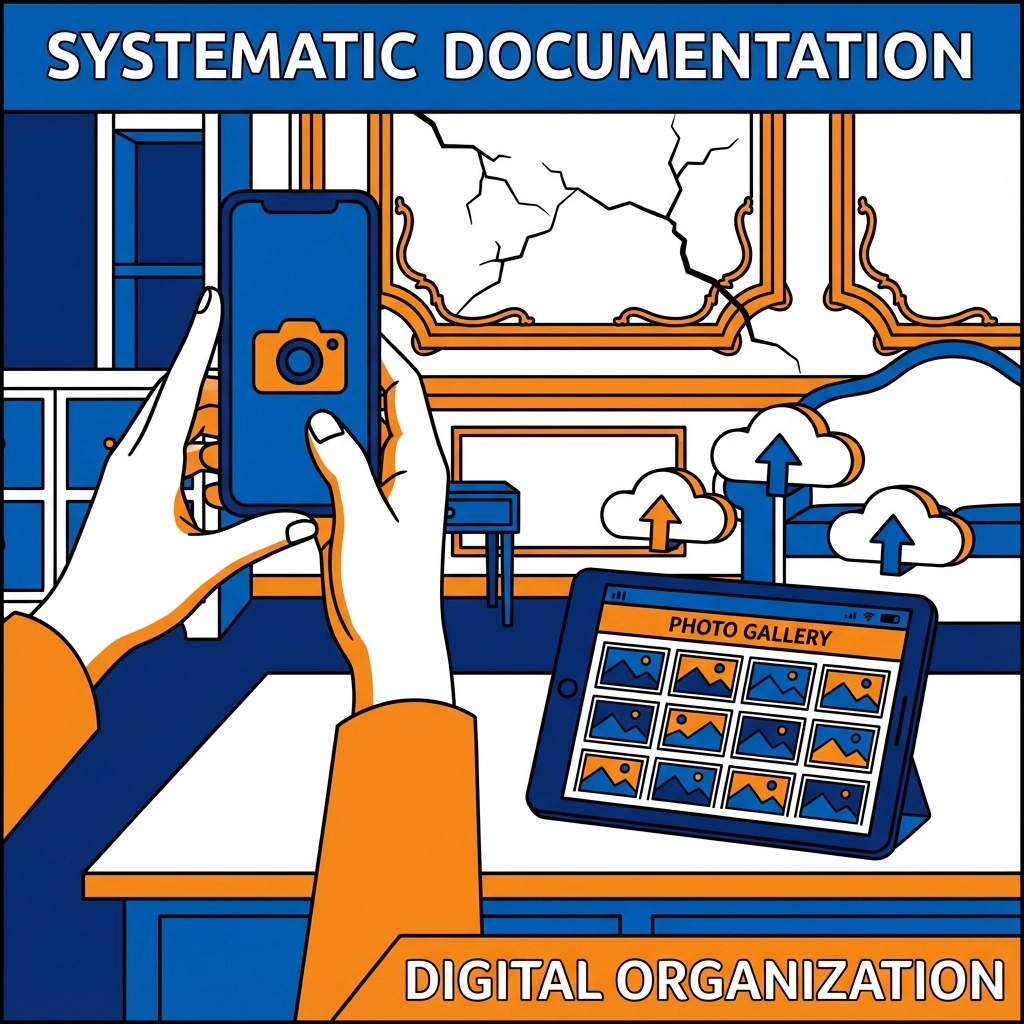

Visual Evidence

Daily photos showing damage and repair progress

Before photos (if available)

Photos of similar undamaged areas for comparison

Video walkthroughs with narration

Digital vs. Physical: Choosing Your Documentation Method

Digital Documentation Advantages:

Cloud backup protects against loss

Easy to share with adjusters and contractors

Searchable text makes finding information quick

Photo organization with timestamps

Voice-to-text for quick entries

Physical Documentation Benefits:

Works during power outages

No technology learning curve

Harder to accidentally delete

Can be signed and notarized easily

Best Practice: Use both methods. Keep a physical notebook for immediate jotting of conversations and details, then transfer information to your digital system for long-term storage and sharing.

Setting Up Your Claims Diary System

Week One: Emergency Documentation

Start with immediate damage documentation and emergency communications. Focus on capturing evidence before cleanup begins.

Ongoing: Systematic Recording

Establish a routine for updating your diary:

Morning: Review previous day's entries

During conversations: Take real-time notes

Evening: Upload photos and organize documents

Weekly: Review and organize all entries

Technology Tools That Work

Cloud storage: Google Drive, Dropbox, or iCloud

Note-taking apps: Evernote, OneNote, or Notion

Photo organization: Google Photos with albums

Voice recording: Phone's built-in app for complex conversations

Common Mistakes That Cost Connecticut Homeowners Thousands

Failing to Document Pre-Loss Condition Many homeowners can't prove their property's pre-loss value because they never documented their investments. Start your claims diary before you need it.

Accepting Initial Estimates Too Quickly Insurance companies often provide low initial estimates hoping you'll accept quickly. Your diary's detailed documentation supports higher, more accurate valuations.

Not Recording Verbal Communications Phone conversations contain crucial information that gets forgotten. Always follow up important calls with email summaries referencing your diary notes.

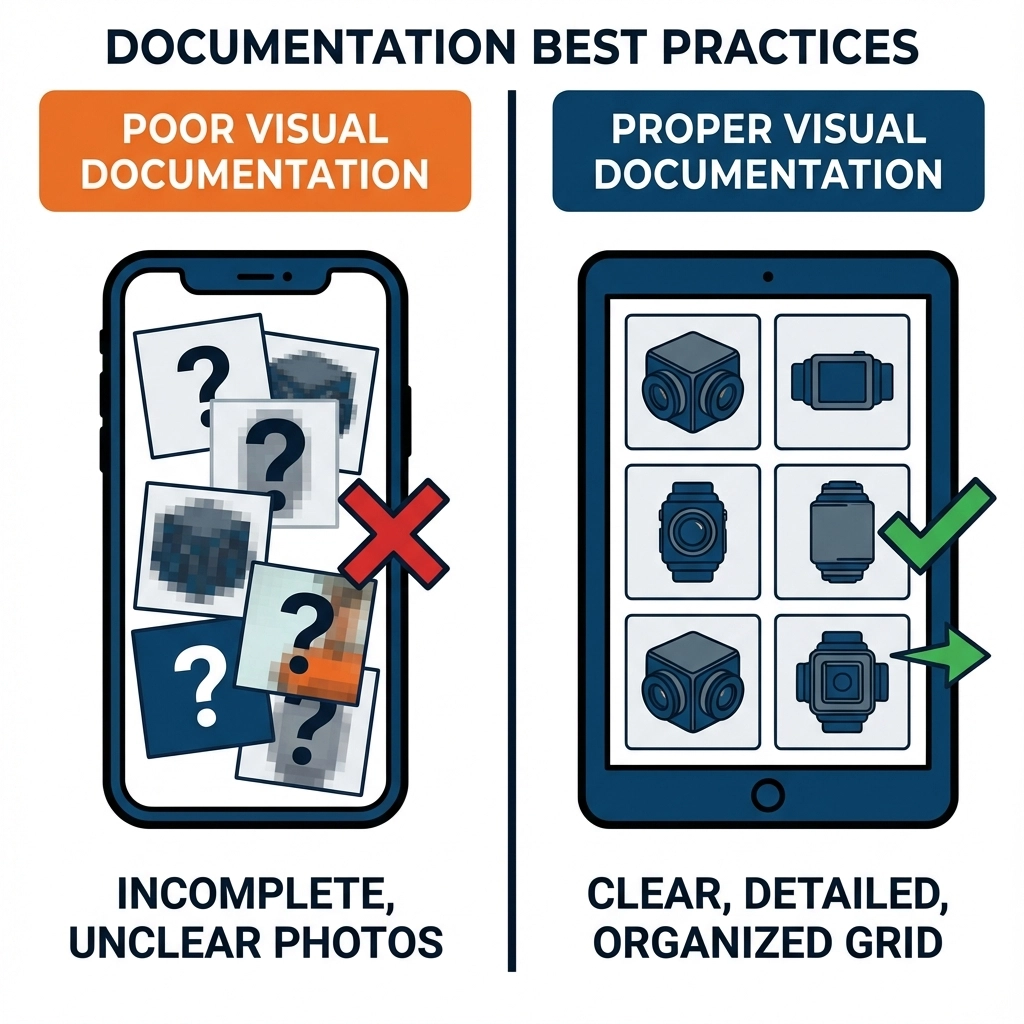

Inadequate Photo Documentation Taking too few photos or poor-quality images weakens your position. Document everything from multiple angles with proper lighting.

How Insure Connecticut LLC Supports High-Value Homeowners

When you work with experienced agents who understand luxury properties, your claims diary becomes even more powerful. Insure Connecticut LLC helps Connecticut homeowners by:

Pre-Loss Planning: We help you set up documentation systems before claims occur

Carrier Relationships: Our relationships with high-value insurers mean faster, more knowledgeable claim handling

Expert Network: We connect you with contractors and appraisers who understand luxury properties

Advocacy: We review your documentation and advocate for proper claim resolution

Claims Diary Quick Reference Table

Documentation Type | Frequency | Storage Method | Key Details |

Photos | Daily during active claim | Cloud storage with local backup | Multiple angles, proper lighting, timestamps |

Communications | After every call/meeting | Digital notes with written backup | Names, dates, commitments, reference numbers |

Receipts | Immediate upon expense | Physical + digital scan | Emergency services, temporary housing, repairs |

Progress Updates | Weekly minimum | Video + written summaries | Repair status, contractor communications, issues |

Expert Opinions | As obtained | Professional documentation | Appraisals, engineering reports, specialist assessments |

The Bottom Line: Protection Through Preparation

Connecticut homeowners with significant construction investments can't afford to approach insurance claims casually. Your claims diary serves as both shield and sword: protecting your interests while providing the evidence needed to secure proper compensation.

The best time to start your claims diary was before any damage occurred. The second-best time is right now.

Ready to protect your investment? Contact Insure Connecticut LLC at 860-440-7324 to discuss how we can help you prepare for and manage high-value insurance claims. Our experienced team understands the unique challenges facing luxury homeowners throughout Connecticut, and we're here to ensure your significant investment receives the protection it deserves.

Don't wait until disaster strikes to discover the gaps in your documentation. Start building your claims diary today and give yourself the peace of mind that comes with proper preparation.

.png)

Banger