Day 7: 7 Smart Questions to Ask Before Buying Commercial Auto Insurance in Connecticut

- W. Tom Polowy, MS

- Jan 8

- 5 min read

Welcome to Day 7 of our week-long journey through commercial auto insurance in Connecticut. You now know the what (key coverages and legal must-haves), the why (real risks, costs, and compliance), and the how (shopping, claims, and day-to-day management). Today, we bring it all together with seven smart questions that sharpen your decision-making and protect your bottom line.

Use these questions as your final checklist—a clear, practical guide to get the right coverage at the right price. Whether you're a contractor in Hartford, a delivery service in New Haven, or a consulting firm in Stamford, you'll walk into any conversation with a broker or carrier confident and prepared.

Question 1: Does My Business Actually Need Commercial Auto Insurance?

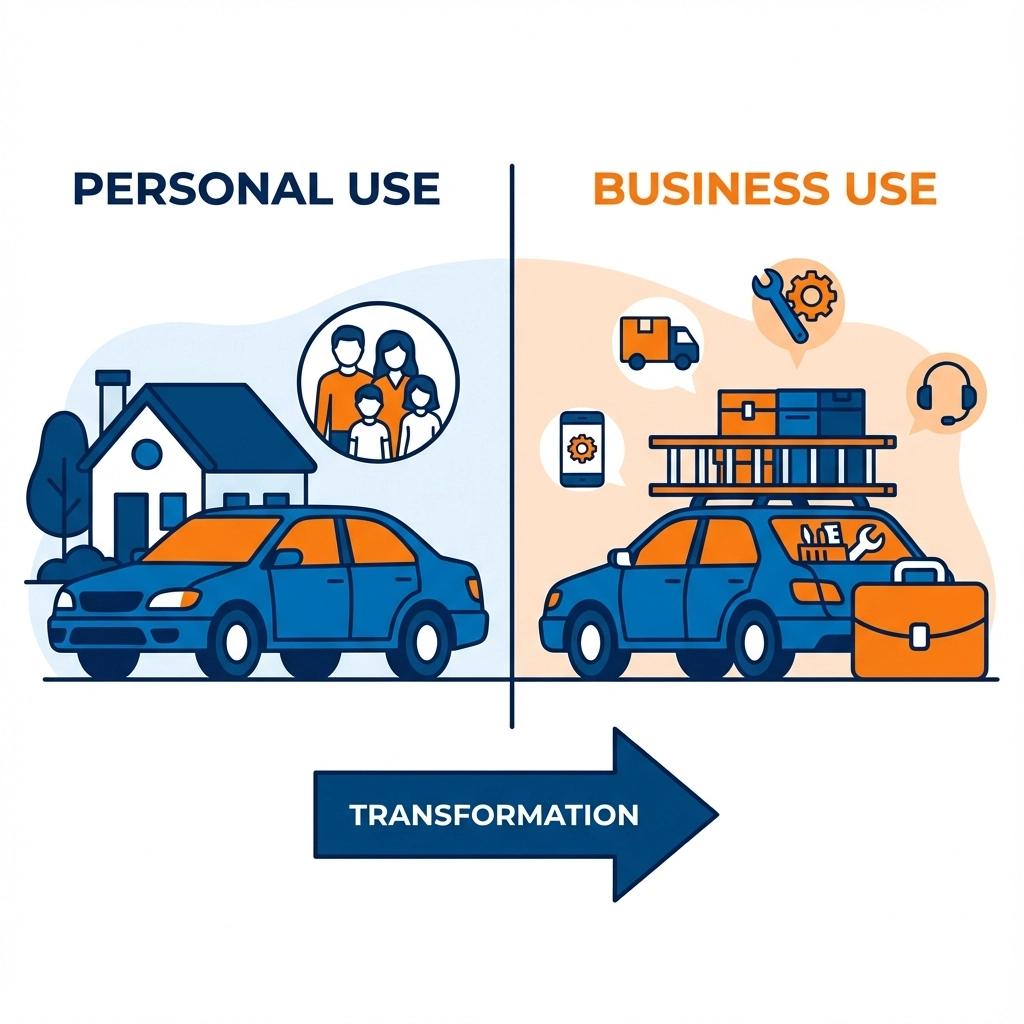

This might seem obvious, but it's the most important question to answer first. In Connecticut, you need commercial auto insurance if you use any vehicle for business purposes: period. This includes:

Driving to job sites or client meetings

Transporting tools, equipment, or materials

Making deliveries or pickups

Having employees drive company vehicles

Using personal vehicles for business purposes

The Connecticut Reality Check: Personal auto insurance explicitly excludes business use. If you're involved in an accident while conducting business activities, your personal policy can deny coverage entirely. This leaves you personally liable for damages that could reach hundreds of thousands of dollars.

Connecticut law is particularly strict about this. Operating without proper commercial coverage can result in fines up to $5,000 and up to five years of imprisonment for serious violations. Don't risk your business and personal assets by assuming your personal policy has you covered.

Question 2: What Are Connecticut's Minimum Requirements for My Specific Vehicle Type?

Connecticut's commercial auto insurance requirements aren't one-size-fits-all. The minimum coverage depends on your vehicle's characteristics:

Standard Commercial Vehicles: Most businesses need at minimum $25,000 per person and $50,000 per accident for bodily injury liability, plus $25,000 for property damage (25/50/25 coverage).

Passenger Capacity Requirements:

Vehicles seating 9-15 passengers: $1.5 million minimum coverage

Vehicles seating 16+ passengers: $5 million minimum coverage

Weight-Based Requirements:

Vehicles over 18,000 pounds (Connecticut only): Annual DMV insurance reports required

Vehicles over 10,000 pounds (interstate operations): Federal requirements apply

Hazardous material transport: Up to $5 million coverage required

Ask Your Broker: "Based on my vehicle's weight, passenger capacity, and intended use, what are the exact minimum requirements I must meet in Connecticut?"

Question 3: Are State Minimums Actually Sufficient for My Business?

Here's where many Connecticut business owners make a costly mistake. State minimums are just that: minimums. They're designed to ensure basic compliance, not comprehensive protection.

Consider this scenario: Your delivery driver causes an accident in Fairfield County, injuring a high-earning professional. Medical bills easily reach $150,000, lost wages add another $200,000, and pain and suffering pushes the total claim to $500,000. Your $25,000 per person coverage leaves you personally liable for $475,000.

Industry Standard Recommendations:

Most insurance professionals recommend $1 million combined liability coverage

Businesses with high-value assets should consider $2-5 million umbrella policies

Companies working with affluent clients need higher limits due to greater exposure

Ask Your Broker: "Given my business type, assets, and typical client demographics, what liability limits do you recommend to adequately protect my company?"

Question 4: Do I Need Uninsured and Underinsured Motorist Coverage?

Connecticut requires uninsured motorist (UM) and underinsured motorist (UIM) coverage for commercial vehicles. This protects you when the other driver either has no insurance or insufficient coverage to pay for your damages.

Why This Matters in Connecticut:

Approximately 8% of Connecticut drivers are uninsured

Many drivers carry only state minimums, which won't cover serious accidents

UM/UIM coverage protects against hit-and-run accidents

It covers your employees driving company vehicles

Coverage Considerations:

UM/UIM should match your liability limits

Consider stacked coverage if you have multiple vehicles

Some policies include UM/UIM for property damage

Ask Your Broker: "What UM/UIM coverage levels do you recommend, and how does stacking work with our fleet size?"

Question 5: What Additional Reporting and Compliance Requirements Apply to My Vehicles?

Connecticut has specific reporting requirements that many business owners overlook. Failure to comply can result in penalties, fines, and coverage complications.

DMV Reporting Requirements:

Vehicles over 18,000 GVWR (Connecticut operations): Annual insurance reports

Interstate vehicles over 10,000 GVWR: Federal Motor Carrier Safety Administration (FMCSA) filings

Commercial passenger vehicles: Additional endorsements and certifications

Documentation You'll Need:

Certificate of insurance for each vehicle

Annual insurance reports (if applicable)

Proof of continuous coverage

Driver qualification files

Ask Your Broker: "What reporting requirements apply to my vehicles, and will you help ensure we remain compliant with all filing deadlines?"

Question 6: How Should I Structure Coverage for My Specific Business Model?

Your commercial auto insurance should align with your business operations, not work against them. Different business models require different coverage approaches.

Contractor/Service Businesses:

Higher liability limits due to job site exposure

Tools and equipment coverage

Non-owned auto coverage for employee vehicles

Delivery/Transportation:

Cargo coverage for transported goods

Higher physical damage coverage

Loading/unloading coverage

Sales/Consulting:

Hired and non-owned auto coverage

Professional liability considerations

Mileage-based coverage options

Fleet Operations:

Umbrella policies for catastrophic losses

Fleet safety programs for discounts

Centralized claims management

Ask Your Broker: "Based on my business model and typical operations, what coverage structure provides the best protection while managing costs effectively?"

Question 7: What's Your Claims Service Like, and How Will You Support My Business?

The true test of any insurance policy comes when you need to file a claim. Your broker's claims support can make the difference between a minor business disruption and a major crisis.

Key Service Questions:

Do you have 24/7 claims reporting?

Will you handle claims communication directly with the carrier?

What's your average claims resolution timeframe?

Do you provide rental vehicle coordination?

How do you handle disputes or claim denials?

Connecticut-Specific Considerations:

Local adjusters familiar with Connecticut laws

Experience with state reporting requirements

Relationships with preferred repair facilities

Understanding of Connecticut's comparative negligence laws

Red Flags to Watch For:

Vague answers about claims process

No dedicated claims support

Unusually low premiums without explanation

Pressure to purchase immediately

Ask Your Broker: "Walk me through exactly what happens when I call with a claim at 2 AM on a Saturday, and how you'll support my business throughout the process."

Making Your Decision: Next Steps

Armed with answers to these seven questions, you're ready to make an informed commercial auto insurance decision. Remember, the cheapest policy isn't always the best value: focus on coverage adequacy, service quality, and long-term partnership potential.

Your Action Plan:

Document your current vehicle usage and business operations

Gather vehicle information (VIN, GVWR, passenger capacity)

Schedule consultations with at least three licensed Connecticut brokers

Ask all seven questions during each consultation

Compare responses, not just pricing

Verify broker licensing through Connecticut Insurance Department

Warning Signs to Avoid:

Brokers who can't answer these questions clearly

Pressure to decide immediately

Quotes significantly below market rates

Reluctance to provide references

No local Connecticut presence

Conclusion: Partner with Connecticut's Commercial Auto Insurance Experts

Over the past seven days, we've built a comprehensive understanding of commercial auto insurance in Connecticut: from basic requirements to advanced coverage strategies. The knowledge you've gained puts you in control of your insurance decisions and protects your business from costly mistakes.

At Insure Connecticut LLC, we understand that every Connecticut business has unique insurance needs. Our team of licensed professionals specializes in creating customized commercial auto insurance solutions that protect your assets while supporting your business growth.

Ready to put your knowledge into action? Contact our West Hartford office at 860-440-7324 for a comprehensive commercial auto insurance review. We'll answer all seven questions specific to your business and provide a detailed coverage proposal with no obligation.

Don't leave your business exposed to unnecessary risk. The peace of mind that comes from proper commercial auto insurance coverage is invaluable: and with the right partner, it's more affordable than you might think.

Call 860-440-7324 today or visit our website to schedule your consultation. Keep these 7 smart questions handy—they'll help every business owner secure great protection. Your Connecticut business deserves protection that works as hard as you do.

.png)

Comments